Have you ever wondered what risks lurk in forex trading? This blog article reveals four nasty traps you should watch out for. From high leverage to psychological pitfalls, find out how to protect yourself. Find out more about successful protection mechanisms, education and preparation as well as the key success factors for your trading. In the end, it is important to weigh up the opportunities and risks in order to operate successfully in the forex market.

Risk 1: High leverage and margin calls

The lure of high profits through the use of leverage in forex trading can be tempting. But caution is advised, because high leverage also carries a high risk. One wrong trade can lead to a margin call, where you have to pay in additional capital to hold your position. This can lead to significant losses and put your entire trading account at risk. It is therefore important to use leverage responsibly and always be aware of the risks. A sound risk management strategy and the use of stop-loss orders can help to protect your capital and limit unwanted losses. Be aware of the dangers and always act wisely to be successful in forex trading in the long term.

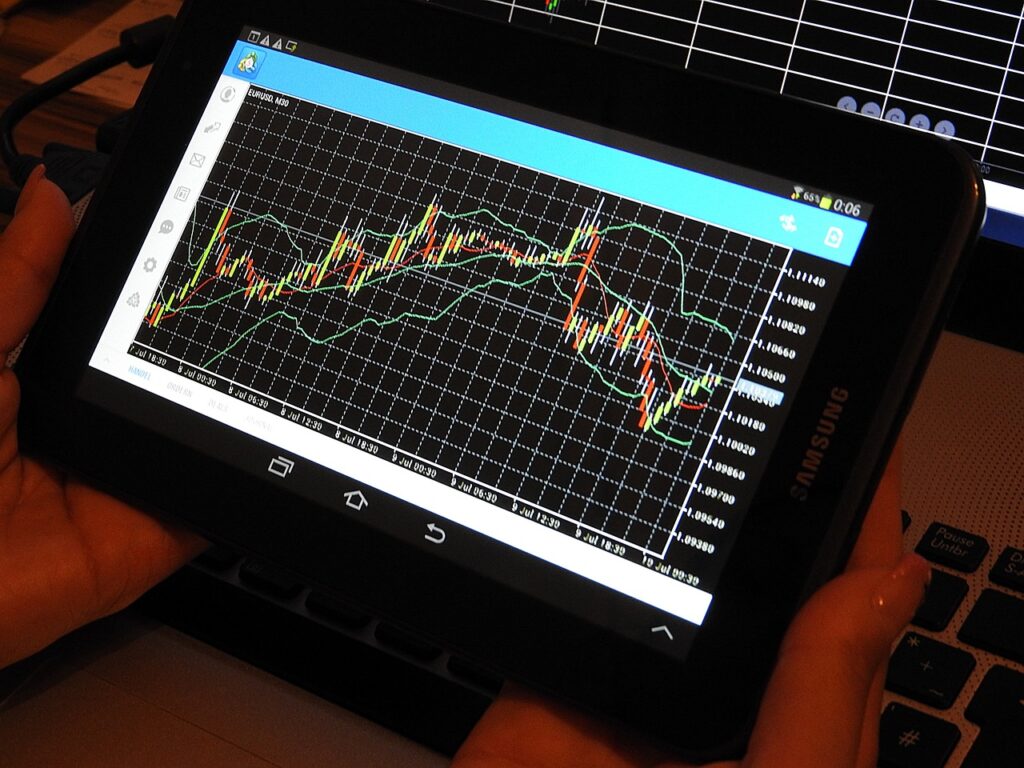

Risk 2: Volatility of the foreign exchange markets

Are you prepared to deal with the volatility of the currency markets? Fluctuations in exchange rates can be a real challenge for inexperienced traders. Sudden price changes can lead to significant losses if you don’t react in time. It is important to monitor market conditions closely and be aware that the situation can change within seconds. Sound analysis and a clear strategy are essential to deal with volatility. A risk management plan that includes both stop-loss orders and profit-taking can help you limit your losses and maximize your profits. Remember that volatility also presents opportunities – if you are well prepared and have your emotions under control, you can profit from fluctuations in the forex market.

Risk 3: Fraud and unregulated brokers

There is a big risk lurking in forex trading in the form of fraud and unregulated brokers. It is important to be aware that not all providers on the market are trustworthy. There are black sheep who try to take advantage of unsuspecting traders and steal their money. Therefore, it is crucial to only trade with regulated brokers that have a valid license. Before deciding on a broker, you should therefore carry out thorough research and read reviews from other traders. Only trust reputable and established companies to minimize the risk of fraud and protect your capital. Stay vigilant and don’t be fooled by unrealistic promises – this is the only way to ensure that you won’t be faced with any nasty surprises.

Risk 4: Psychological pitfalls in trading

Forex trading not only involves financial risks, but also psychological pitfalls that can affect your trading results. The constant fear of losses or greed for quick profits can lead to ill-considered decisions. Emotions such as fear, greed and exuberance can cause you to neglect your strategy and act impulsively. It is important to keep a cool head and remain disciplined. A good trader knows their own emotional weaknesses and works to control them. A clear risk management strategy and adherence to stop-loss rules can help to avoid emotional decisions. Remember that trading is not just a game of the mind, but also of the psyche. Be aware of your psychological pitfalls and continuously work on your mental strength to be successful in the long run.

Protection mechanisms: stop-loss and risk management

When it comes to protecting your capital in forex trading, stop-loss orders and effective risk management are your best allies. By setting stop-losses, you can limit losses and control your risk. Well thought-out risk management also helps you to protect your capital and make sensible trading decisions. By setting clear rules for your trades and strictly monitoring your risk, you can minimize potential losses and be successful in the long term. Remember that protecting your capital should be a top priority when you are active in the forex market. With stop-loss orders and disciplined risk management, you can avoid the nasty pitfalls of trading and increase your chances of profitable trading.

Education and preparation: the key to successful forex trading

Before you jump into forex trading, you should be aware that education and preparation are the keys to success. Without the necessary knowledge of the market and the various trading strategies, you could easily fall into a trap. By continuously educating yourself and sharpening your skills, you can better respond to the challenges of forex trading. Only when you have a solid understanding of the markets can you make informed decisions and minimize potential risks. Therefore, invest time and energy in your education to be successful in the long term. Remember that the foreign exchange market is fast-moving and constantly changing. Good preparation is therefore essential to meet the demands of trading.

Success factors: discipline, patience and control

When it comes to successful forex trading, discipline, patience and control play a crucial role. Without these key factors, it is difficult to trade profitably in the long term. Discipline helps to stick to set rules and strategies, even though it can be tempting to make spontaneous decisions. Patience is important to wait for the right trading opportunities and not to act hastily. Control over your emotions is essential in order to trade rationally and not be manipulated by fear or greed. By integrating these success factors into your trading, you can significantly increase your chances of long-term success and minimize the risks.

Conclusion: Weighing up the opportunities and risks of forex trading

Before you jump into forex trading, it’s important to understand the potential risks. The high leverage and margin calls can lead to huge losses if not traded carefully. In addition, the forex markets are extremely volatile, resulting in rapid price changes and unexpected developments. Fraud by unregulated brokers is also a real danger that must be countered. Psychological pitfalls such as greed and fear can influence your decisions. But there are safeguards such as stop-loss and risk management that can help limit losses. A solid education and preparation are key to successful trading. Discipline, patience and control are key success factors. It is essential to carefully weigh up the opportunities and risks of forex trading to ensure long-term success.